2018 Housing Giants: Strategic Cost Cutting

The biggest news in the home building industry in 2017 was, without a doubt, the purchase of CalAtlantic by Lennar, the largest-ever merger involving the nation’s Housing Giants. The combined company will likely be the No. 1 home builder in the U.S. in 2018 in both revenue and closings. While the deal did not close until February of this year, the agreement was hammered out by the end of October 2017. With its $9.3 billion price tag (including debt), Lennar will shell out three times as much as Pulte did for Centex in that merger of Giants in 2009, but is undoubtedly counting on a better return than that transaction garnered. In addition to gaining a substantial and lucrative foothold in California’s thriving housing market, Lennar‘s deal will allow the company to pursue lower costs for labor and materials in all of its combined markets. The company expects to save $325 million in cost savings over the next two years alone. Stuart Miller, now Lennar’s chairman—Rick Beckwitt took over from Miller as CEO in April—has said that the merger’s main goal was to create those economies of scale.

There was plenty of other M&A activity in 2017, as well, as home builders of all sizes tried to increase their footprints without having to start from scratch in a new market. To name just a few: Fischer Homes moved into Louisville with the purchase of Dogwood Homes; Stanley Martin extended its reach into Georgia and South Carolina with Front Door Communities; AV Homes took another position on the East Coast with Savvy Homes, in Raleigh. N.C.; and CalAtlantic, before being swept up itself by Lennar, established a presence in Seattle with Oakpointe Communities and in Salt Lake City with Candlelight Homes.

There have always been and always will be mergers and acquisitions in the home building industry as a means of growth, but it seems as if builders are starting to consider it more difficult, and riskier, to move into a new market in any other way. Clayton Homes, traditionally a modular, off-site builder (represented on our cover this month by CEO and president Kevin Clayton and president of Clayton Home Building Group Keith Holdbrooks), takes the acquisition model a step further by acquiring home building companies around the country and allowing them to continue operating as-is, with their own names and management teams. With its 2018 purchase of Austin’s Brohn Homes, Clayton’s site-built operations are expected to close more than 3,100 homes by the end of this year.

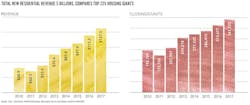

All of this movement among the country’s largest builders makes home building seem quite active and robust as it continues to unwind itself from the recession. And there has been substantial improvement in the industry’s numbers. Since the recession’s low point in 2011, annual new-home sales have doubled, to 614,000, with a year-over-year increase of 9.4 percent at the end of 2017. Last year, there were nearly twice as many single-family starts, 849,000, as there were in the depths of the recession, with 2017 starts increasing 8.6 percent over the previous year. But while 2017’s new-home sales, starts, and permits are now the highest seen since 2007, they still remain at historically low levels, creating a supply issue that keeps the industry from meeting the current demand for new homes.

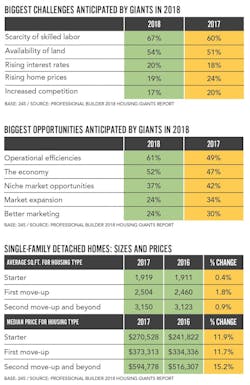

For some years now, the Housing Giants survey has shown that the biggest challenges home builders face in trying to keep up with demand are the scarcity of skilled labor and the availability of land. Jumping up to No. 3 in the survey this year is the specter of rising interest rates; rising home prices are a close tie at No. 4. This change in builder concerns points to the real issue facing nearly every builder: affordability. Recent research from Arch Mortgage Insurance Co., a provider of private insurance covering mortgage credit risk, reports that U.S. housing became 5 percent less affordable in the first quarter of this year, and that number may increase to 15 to 20 percent by the end of 2018. That would make 2018 the worst year for decreasing affordability in the past 25 years.

Nationwide, home building companies are attempting to find new ways to provide more affordable homes to the multitudes of prospective buyers who are starting to form new households or are currently renting. They are providing smaller lots and smaller homes in less developed areas, and fewer bells and whistles, for sure, but also innovative financing programs and warranties ensuring there will be none of the surprise costs that so often come with existing homes.

But builders are also looking to shoulder their share of the costs. Sixty-one percent of this year’s survey respondents said their biggest opportunity in 2018 lay in operational efficiencies. Companies that act to trim their expenses and implement more efficient methods of construction should be able to offer lower prices and, perhaps, see additional profit, as well.