Editor’s note: This article is the first in a series about the mergers and acquisitions (M&A) market for private home builders, an important issue for anyone who owns, competes against, or works for these companies. A host of factors have pushed large public builders and foreign builders to seek to buy private builders, making the “sellers” more valuable. Future articles will discuss builder valuation, the M&A process, and other related topics.

Current Challenges Facing Big Builders

Big builders want to grow—typically, 10% to 15% annually. However, the current challenges facing home builders—scarcity of finished lots, labor shortages, and supply chain issues—have made it increasingly difficult for big builders to meet their annual growth commitments to shareholders.

As such, public and foreign builders are actively looking to buy privately held home builders with existing land and built inventory that can immediately fill revenue, profit, and closings shortfalls.

This situation continues a trend that existed just before the COVID-19 pandemic. In 2019, Pro Builder cited research showing that M&A deals for home builders had risen from eight in 2016, to 13 in 2017, to 21 in 2018. And last year, our research shows at least 22 home builder M&A transactions in 2021.

More Buyers for Home Building Companies and a Range of Deal Structure Options

Five years ago, if you wanted to sell your home building company, the buyer pool was primarily limited to publicly traded builders in the U.S., but the industry has evolved. Now there are a variety of large, well-capitalized companies looking to grow through acquisition, including foreign builders (namely from Japan and Canada), Clayton Properties Group (a unit of Warren Buffet’s Berkshire Hathaway), special-purpose acquisition companies (SPACs), single-family rental (SFR) operators, investor groups “rolling up” a number of small builders, and large private home builders.

The potential buyers have various objectives, resulting in a broad range of deal structure options:

- Sell the entire company or just a portion

- Stay to grow the business with the strong financial backing of your acquirer, or exit completely

- Keep the brand and run autonomously or get absorbed into a larger company and brand

As a result, private owners of all ages and motivations can sell their home building business on a timeline and terms that meet their specific goals.

RELATED

- The Housing Industry's Age of Acquisition

- Wheelin’ and Dealin’: Merger and Acquisition Activity

- 6 Essentials for Managing Through a Merger or Acquisition

Builder Company Size Matters for Lowering Overhead and Raising Margins

Some big builders want to grow within the markets they already serve. They seek additional land positions and high-quality personnel. These M&A deals are referred to as “bolt-on” transactions.

The motivation is clear: size matters. Driving more revenue through an existing management team results in lower overhead costs and increased margins.

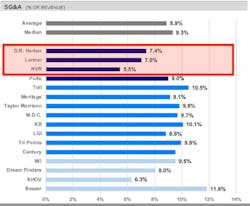

The chart below examines 17 large Sun Belt markets, in which either D.R. Horton, Lennar, or NVR is the largest builder. Delivering massive revenue through those local markets creates efficiency.

Now look at the next chart. Those same companies are the three largest U.S. publicly traded home builders by market cap. You will note that those three builders have significantly lower overhead (selling, general, and administrative expenses, or SG&A) than their publicly traded peers. It makes sense because size drives efficiency, resulting in lower overhead costs and higher margins.

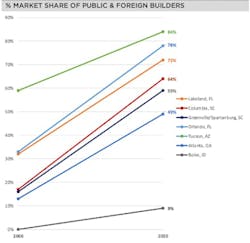

Secondary Markets Are Now Attractive to Big Builders

Some big builders want to expand into new markets. These buyers seek seasoned management and operations teams with local knowledge, trade and vendor relationships, and quality land positions.

Earlier in the current economic cycle, big builders geographically expanded into primary markets. Now they are aggressively moving into the secondary and tertiary markets.

We’ve seen this dynamic play out in markets such as Greenville, S.C., and Huntsville, Ala., where public and foreign-owned builders have purchased private builders. This has created a window of opportunity for high-quality private builders in secondary markets, which are often overlooked, to sell their company.

RELATED

- NAHB Releases 2022 Business Study

- What’s Your Core Competitive Strategy?

- How Small and Medium-Size Builders Can Prevail

Why Builder Consolidation Will Continue

On the supply side, an increasing number of private builders have grown to the size and scale necessary to be attractive to potential buyers. Here are some reasons why:

- Consolidation has already occurred in primary housing markets and is now happening in the secondary markets, and we expect that trend to continue

- Competition for land, employees, trade partners, and customers will increase

- Strong private home builders will continue to thrive. Their long-standing relationships will protect them, even as margins come under pressure

- Private builders that are undercapitalized, lack quality team members, or suffer from operational inefficiencies may have a tougher time

The Result: A Healthy M&A Market for Home Builders

All of these factors add up to good news for builders considering a sale of their business. Current market dynamics have created a window of opportunity for private builders with solid margins, quality land positions, and strong teams to monetize their business.

Chris Jasinski is a managing partner and co-founder of JTW Advisors, a mergers and acquisitions advisory firm focused exclusively on the home building industry. Chris can be reached at [email protected].