2022 Housing Forecast: Opportunities and Challenges

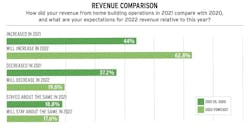

On the heels of a tumultuous 2020, the past year in home building was a lesson in contrasts: a hot housing market with record-setting new-home sales and prices was balanced by supply chain delays, skilled labor shortages, and materials price increases that hindered new-home production.

For the most part, home builders weathered the housing market's challenges well, despite angst and adjustments, delivering about 1.24 million new homes in 2021. And they expect to continue that trend into 2022, according to our annual Reader Forecast Survey. Representing a wide swath of builders nationwide, the data paint a picture of optimism and opportunity for the residential real estate, tinged with ongoing challenges.

Housing Market Predictions for 2022

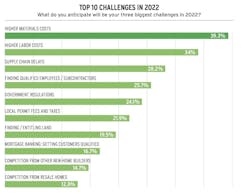

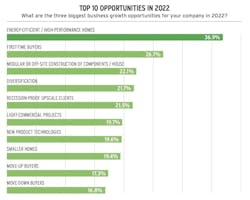

Among the opportunities and challenges for the housing market (see the first two charts, below), the pleasant surprise is that about one-fifth of builders see some sort of industrialized construction in their near-term future, followed closely by new product technologies, and those opportunities likely reflect the top three challenges cited.

“We expect innovation in the industry will continue in 2022 due to higher development costs,” says Robert Dietz, chief economist for the National Association of Home Builders, which forecasts a leveling off of single-family production thanks to ongoing headwinds.

RELATED

- Forecasting the Future of Home Construction

- 2021 Housing Giants Report: An Unforgettable Forgettable Year

- Home Builders: Get Ready for 2022

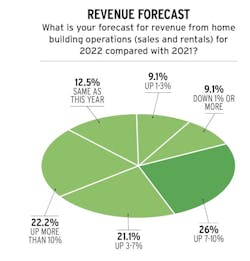

Still, nearly 80% of builders expect to sell more homes next year, with 37.2% of those forecasting to sell 21 or more homes than they did in 2021. With that, more than half of builders expect their revenue to climb at least 7% over this year.

Pandemic-driven factors also will continue to affect the industry. “Work from home, at least part time, is a massive stimulus to many areas where homebuyers and renters can get far more house for their money,” says John Burns, CEO of John Burns Real Estate Consulting. “The future is very different by market and submarket.”

Methodology and respondent information: The 2022 Reader Forecast Survey was distributed to Pro Builder’s print and digital readers between Sept. 5 and Oct. 2, 2021, as well as to builder members and clients of The Shinn Group–Builder Partnerships, Do You Convert, TrueNorth Development, SMA Consulting, IBACOS PERFORM, and the Housing Innovation Alliance. Recipients were offered the chance to win one of four $50 Visa gift cards for completing the online survey. Gift cards were awarded in October 2020. As many as 1,129 responses were recorded and 1,081 surveys were completed. Results were rounded to the nearest whole number.