2020 Housing Giants Report: The Magnificent Middle

Maybe it’s because I’m the second child of three, or a member of a generation wedged between Baby Boomers and Millennials, or because I root for a perennial .500 baseball team, but I have a soft spot for builders in the middle of our Housing Giants rankings.

Often overshadowed by their overachieving big brothers (the publics) or über-creative and nimble smaller siblings, production builders in the center of our annual list rarely get much attention—the classic middle-child syndrome.

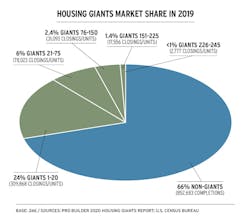

And why should they? After all, those ranked from 21 to 150 by revenue commanded only about 8.4% of all home closings in 2019, while the market share among the top 20 continued to grow … often by gobbling up well-run and profitable builders occupying the ranks below them.

But viewed another way, those midsize, mostly local Giants collectively averaged 418 closings per workday last year and corralled nearly $41 billion in sales revenue that supported local economies in Portage, Mich., Monroe, N.C., Roseville, Calif., and Brentwood, Tenn., among dozens of other communities.

They also account for every one of the builders that have earned a National Housing Quality (NHQ) Award for operational excellence over the last decade, and make up seven of our annual Builder of the Year honorees since 2011. They may not be well-known outside of where they build, but as a group they are an impressive bunch of builders looking to get better and sustain success.

RELATED

- 2020 Housing Giants Ranked

- How Small and Medium-Size Builders Can Prevail

- Paycheck Protection Program: Builders Uncertain But Hopeful Pursuing Coronavirus Relief Loans

- Stretching Out: How diversification is helping midsize production builders compete with their bigger brethren

- Previous: 2019 Housing Giants Report

Model Middle Builders

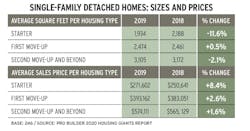

Consider The Villages of Lake Sumter, in Central Florida, No. 37 on this year’s list with nearly $600 million in total home building revenue from 2,287 closings and more than $166 million in developed lot sales. The third-generation company, founded in 1959 by president Mark Morse’s grandfather, focuses exclusively on detached single-family homes priced in the $320s for active adults, a strategy that boosted the company six spots from #43 in last year’s ranking.

Or No. 115, Tim Lewis Communities, in Roseville, Calif., northeast of Sacramento, which earned $137.3 million last year on “just” 205 closings, gaining in both counts compared to 2018. Offering a mix of starter and first- and second-move-up product priced from the $380,000s to $800,000s, most of it presold, the company made plans to expand into nearby Yolo County in 2020.

Midsize, mostly local Giants collectively averaged 418 closings per workday last year and corralled nearly $41 billion in sales revenue that supported local economies.

Then there’s No. 142, Tilson Home, in Houston, founded way back in 1932 (during the Great Depression, if you’re looking for inspiration), which bagged $105 million across 367 closings in 2019. Building on scattered infill and rural lots, the company opened a new, smaller model last year in Huntsville, about 70 miles north of Houston, to better suit the expectations of buyers in an acre-lot neighborhood.

Right behind them is Hakes Brothers at No. 144, a Las Cruces, N.M., builder that racked up $104.8 million on 421 closings of entry-level and move-up homes, all within the $200,000s (and a third of them energy certified) for buyers in the company’s home state and neighboring Texas.

And don’t forget True Homes, in Monroe, N.C., winner of an NHQ Gold Award in 2019, which rose four places to No. 47 in the rankings after earning $432 million on 1,663 closings in 2019, a leap of $30 million and 104 units from 2018.

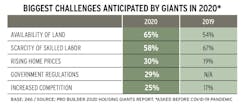

Such successes last year were expected to springboard these and other builders into an even better 2020 ... plans that were derailed within the first quarter by a global pandemic. “The big question is how long the tail will be on the shutdown and recovery,” said one midsize builder. “That will set the tone for 2021.”

Looking Back

Even just a few months into 2020, it seemed so long ago that many in the housing industry were celebrating 2019 as the end of a long recovery from the Great Recession.

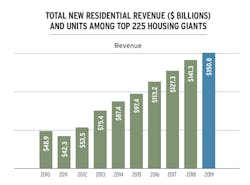

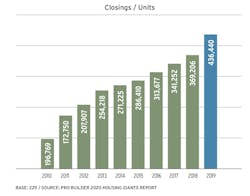

That sentiment was true even in light of a six-month hangover after a poor end to 2018 ... until the Fed dropped interest rates in July 2019 (and again in September and late October) to spark a resurgence in sales traffic and actual sales. The 328,000 new homes started in the fourth quarter of 2019 were the highest since 2005, contributing to 1.37 million for the year, a 3.1% annual gain. Within that number, single-family starts ended slightly up over 2018, while the multifamily sector enjoyed its best year since 2011.

Based on that performance, bolstered by low interest rates and inventory, the seasonally adjusted annual rate for 2020 was pegged at 1.55 million housing units as of January’s numbers—a 9.2% gain—and permits issued in the top 20 markets in January 2020 were a whopping 48% better year over year. Single-family home sales were predicted to top 760,000—a 19% gain from a year before—and private residential construction spending was up 9% to $5.54 billion over the same period.

Then COVID-19 hit, and the party ended.

Looking Forward

For sure, the most recent metrics for housing are bad in the midst of health-related work restrictions, but the strength of the industry coming out of 2019 and through February of this year indicates it will help lead the country back from its latest brink.

“The end of 2019 was unusually strong for a fourth quarter and all of the underlying fundamentals of housing look fairly healthy,” says Devyn Bachman, senior manager of research at John Burns Real Estate Consulting. “We won’t jump back to where we were on March 1st, but absolutely there is some resilience.”

In addition to low interest rates, 1.2 million units in progress as of March, and multiple federal stimulus packages to keep money flowing into the economy, Bachman is impressed and encouraged by how quickly builders adapted to the health crisis. “Builders were forced to figure out technological solutions to help maintain sales and serve customers,” she says, pointing to virtual reality platforms, video conferencing, electronic documentation, and remote door locks to allow scheduled model home tours minus the sales rep.

National Association of Home Builders chief economist Robert Dietz is similarly encouraged, if also wary of an uncertain future for the economy as a whole and housing’s relative strength and resilience. “Ours was among the more conservative housing forecasts for 2020,” he says, recalling NAHB’s prediction for 3% growth while others were double that or more. “Housing was up a little bit in 2019 [compared with 2018], and builder confidence was strong.”

And, unlike the Great Recession, which Dietz describes as a financial crisis that snowballed into a massive overhang of housing inventory, among other ripple effects, “We entered this COVID-19 situation in a totally different position,” he says, “with a lack of inventory that won’t result in a flood of homes entering the market and only a slight decline in pricing.”

Of course, the longer restrictions linger, or if a widespread rebound of the virus occurs, housing’s relative strengths won’t likely be as sustainable. “How it plays out really depends on the U.S. economy,” Bachman says. “At some point, it doesn’t matter how well housing looks, there won’t be homebuyers confident enough to purchase.”

HOUSING GIANTS DATA: 2020 HOUSING GIANTS RANKINGS

Access a PDF of this article in Pro Builder's May/June 2020 digital edition