Holding Back the Headwinds

Was 2022 a bad year? Historically speaking, no, far from it. But it kinda felt that way, didn’t it? Maybe not like the sky was falling, but there weren’t a lot of cloudless days, either. It was more like a fog, a bog, a slog.

Our latest list of Housing Giants, as ranked by home building revenue in 2022, can attest to that. Sure, these builders collectively closed more houses and collected more money last year than the year before (see charts, below), but it certainly wasn’t easy ... or certain. Rising interest rates, skyrocketing home prices, and talk of an impending economic recession will do that.

What's in Store for Home Builders? Data From the Nation's Biggest Builders Offers Insights

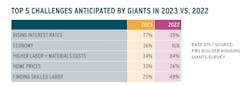

And those storm clouds remain as we close out the first half of 2023. While the Federal Reserve seems satisfied at the moment that inflation is cooling as intended, the housing industry is still leaning into significant and seemingly chronic headwinds of low supply, lack of affordability, and escalating costs for construction materials and labor—factors that caused 42% of these builders to forecast, on average, a 21% drop in revenue this year, while 14% of them expect to make the same as in 2022.

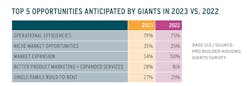

Still, last year also proved, once again, that U.S. home builders are a resilient bunch, led by Housing Giants seeking several ways to return to solid ground, including expanding into new markets and niche segments such as build-to-rent, honing their operations to be more efficient, entering into joint-venture partnerships to spread risk, and expanding their products and services, among other tactics.

And while the general economy is high on their list of challenges, a fair share (17%) see it as an opportunity to grow, take market share, or pick up the pieces (and ideally land holdings) of others less able or nimble enough to weather the storm.

So yes, 2022 was a “meh” year, one that will likely pass easily out of our memory once the clouds part and the footing firms up ... whenever that happens.

After peaking at nearly 25% market share among the Top 20 Housing Giants, and just over 36% of all closings/completions in 2021 among all Giants, the nation’s largest builders took a big step back in market dominance, enabling non-Giants to essentially return to pre-pandemic levels.

New homes shrank a bit in 2022, but prices exploded across the board as supply of both new and existing units on the market continued to lag behind demand thanks to drags on production and hikes in mortgage interest rates.

Builders are looking both outward (to new markets and niche opportunities) and inward (improving operations, product marketing, and expanding services) to combat ongoing challenges and find some solid ground ... literally and figuratively.

What a difference multiple interest rate hikes make, dominating the list of challenges and relegating hard costs and skilled labor shortages to almost afterthoughts among the headwinds the nation’s largest builders expect to face through this year.

RELATED

- 2023 Housing Giants List: Ranking the Biggest U.S. Builders

- 2023 Housing Giants: Housing, Industrialized—Designing for Off-Site

- Rethinking Housing Design in 2023

- Built to Rent Is Booming, But Operational Challenges Loom for This Housing Sector

Housing Giants again increased their collective revenues by at least 20% last year, on par with 2021, but more than half of them (55%) forecast flat or declining numbers in 2023.

Giants only managed to close 8,674 more homes than they did in 2021, a pedestrian 1.8% gain that reinforces the ongoing problems hindering production.

SURVEY METHODOLOGY: The 2023 Housing Giants’ Survey was distributed to Pro Builder’s print and digital readers between January and mid-March 2023, resulting in more than 260 responses and ultimately a verified list of 240 companies ranked by their 2022 home building revenue.

Access more Housing Giants content, including rankings by housing type and geographical region