2021 Housing Giants Report: An Unforgettable Forgettable Year

How will 2020 be remembered in the history of the U.S. housing industry? As one in which home builders bounced back quickly from a sudden stoppage of life as we knew it to lead a ravaged economy out of the COVID-19 wilderness?

Or maybe one that saw a giant, accelerated leap forward in the use of technology to market and sell homes and adjust to remote working in their own operations and those of suppliers, building inspectors, and permit offices, not to mention homebuyers.

Whatever its legacy, for housing and the world, 2020 was a year that forced changes that likely will linger in a new normal, tinged with the tragedy of a ruthless and indiscriminate virus but countered by resiliency and nimbleness.

It’s kind of hard to remember (or maybe simply not worth the brain space) just how strongly 2020 started for new housing. Permits were at a seasonally adjusted annual rate (SAAR) of 1.55 million in January, the highest since 2006, while the top 20 metro markets averaged a year-over-year gain of 47.5%.

SEE THE LIST: 2021 Housing Giants Ranked List

With that, home sales and construction spending were up, while prices were holding steady thanks to about six months of inventory. It was a clear signal that the industry had finally fully recovered from the Great Recession.

And then ... a global pandemic. Everything stopped, and what had been certain became confusion and angst.

Of all the industries affected (and there wasn’t one left unscathed), housing was one of the fortunate few; by most estimates, 90% of construction activity was deemed “essential,” save for a few states and municipalities that felt otherwise, albeit with new and sometimes confusing (and certainly unbudgeted) restrictions designed to “flatten the curve” of escalating COVID-19 cases.

Housing production slowed, as fewer workers were allowed on jobsites at any one time; the true state of the building products supply chain came into sharp relief; and municipalities struggled to use online-only processes for building permits and inspections.

By March, the SAAR for new-home building permits had dropped to 1.38 million—about level with year-end 2019—and would bottom out in April at 1.09 million, a valley not seen since 2014. Even so, projects continued, bills got paid, and most workers were able to keep working. New-home completions remained strong, thanks to a backlog of work in the pipeline. Compared with the airline and restaurant sectors, housing was in an enviable position a year ago.

MORE HOUSING GIANTS DATA: Additional 2021 Housing Giants ranking lists—home builders ranked by number of closings, housing types, and location of homes built

The V-Curve and Housing's Role in Economic Recovery

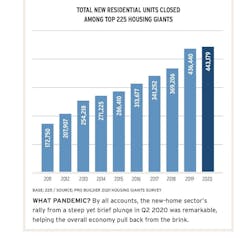

As early stay-at-home restrictions eased in May 2020 and through the summer, housing quickly got back on track. By July, estimated annual permits were back to 1.54 million and closed the year at 1.76 million, well ahead of pre-COVID projections and more recent fears. Pundits lauded housing’s role as a key economic engine as other sectors struggled to adjust and recover.

Along the way, lifestyle changes caused by pandemic restrictions appeared on housing’s radar. With millions of people forced to work and exercise from home (and many managing remote learning for their kids, to boot), their existing homes quickly proved inadequate for the new normal. Designers and builders responded with floor plans offering maximum flexibility; multiple home offices scaled for Zoom calls instead of in-person meetings; exercise rooms carved out of garages and sized for smaller, tech-driven equipment; and guest suites for bounce-back adult children or elderly parents ... or maybe to quarantine a member of the family.

Kitchens got smarter about handling bulk storage items (remember the run on toilet paper and hand sanitizer?), while the family entry from the garage became a way station to shed remnants of the outside world, both physical and emotional—that is, if you ever left the house. Secure package delivery areas and video doorbells went from “what’s that?” to “gotta have it” in the span of a few months.

Some of those changes, namely telecommuting and in-home gyms, were already trending, while others were more of a reaction to extreme conditions. Still, the changes in product design driven by COVID were smart, reasonably scaled, and attractive—and are therefore likely to remain in homes beyond the pandemic.

The Flipside for the Housing Industry

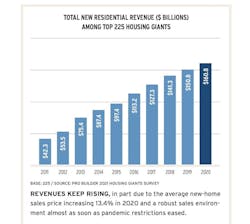

As good as the end of 2020 was for housing—so much so that this year’s Housing Giants expect to increase their revenues by an average of 18.3% in 2021—the industry still faces significant challenges that were masked by the pandemic initially but roared back into the spotlight as the market took off.

Arguably the strongest headwind is the skilled labor shortage. At of the end of Q1 2021, the industry faced a deficit of 344,000 workers, a third more than before the pandemic. With that, 85% of home builders report a skilled labor shortage, chiefly among framers, carpenters, and masons, and are increasingly willing to offer better pay, benefits, and working conditions to attract and retain talent.

Just as troubling is the year-long surge in materials prices and longer lead times from a global supply chain hobbled by the pandemic. And it’s not just framing lumber (with prices up 300% since April 2020), but also steel, ready-mix concrete, plumbing and lighting fixtures, and windows, among several others.

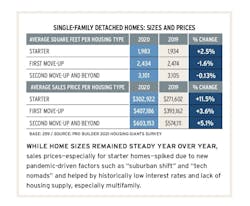

That one-two punch amid record demand for new homes has, of course, further eroded housing affordability. The average price of a new single-family home now hovers around $400,000 (spiking to $416,000 in February), a full $50,000 more than in January 2020.

Housing: Looking Ahead

Today, there’s talk of a housing “bubble” that will burst, causing an inevitable “course correction,” an event that would ideally allow builders to catch up on the supply side and perhaps ease supply chain issues as sales ebb for a while.

The likelihood and extent of that correction, of course, is unknown. But if it happens, and housing’s response to the wild and crazy uncertainties of the coronavirus are any indication, there’s real hope that the industry will again prove resilient.

Read More From the 2021 Housing Giants Report

You still need a checkbook, but for home builders finding and acquiring land also requires planning, perseverance, and thinking outside the box.

Never before have home builders had to navigate a market where houses are pre-selling fast while the cost of so many resources is rising and so many supplies are constrained at the same time.