National Homebuying Trends That Give Builders an Edge in Local Markets

The best way to find out what prospective buyers want in a new home is to ask them. Whether you send a survey, query them in the sales office, or corner them at an event (ideally all three, and more), taking the pulse of your local market is critical to strategizing your approach to that market.

By contrast, national trends, while not a precise indicator of local demand, can, and should, play a role in starting conversations with local buyers to validate or tweak general trends to meet local preferences.

In this article, we share key results from three recent national studies looking at consumer homebuying trends to reveal opportunities to create competitive distinction, get ahead of the curve, and sustain profitability.

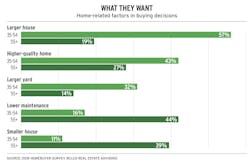

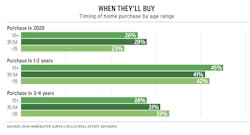

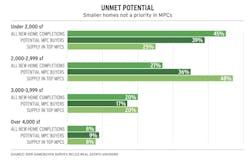

Consider the data gleaned by RCLCO Real Estate Advisors showing unmet demand (read: opportunities) to provide smaller, denser, and attainably priced housing in an “inclusive” master planned community context, ideally on urban fringe green- or brownfield sites with ready access to existing infrastructure and services—something Millennial buyers especially covet. “There are more people interested in making trade-offs for smaller homes and lots to buy in a master plan than we are currently providing product,” says Gregg Logan, the firm’s managing director and author of the study (see chart, next page). “And that model has proven to be profitable for developers and builders.”

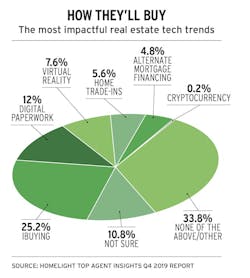

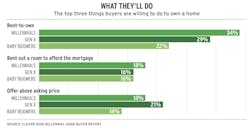

Other national trends that also can be predictive for local markets include technologies that streamline homebuying and selling. While not especially prevalent now, innovative options such as iBuying, virtual reality, home trade-ins, and alternate mortgage financing (see chart, below) are edging toward the mainstream.

Methodology: The 2019 Homebuyer Survey from RCLCO Real Estate Advisors derived data from 3,000 respondents aged 18 and older with an annual income of at least $50,000 who are planning to buy a home within three years. The Top Agent Insights Q4 2019 Report from HomeLight surveyed 500 leading real estate agents nationwide. The 2020 Millennial Home Buyer Report from Clever, an online real estate referral service, surveyed 1,000 Americans planning to purchase a home in 2020.

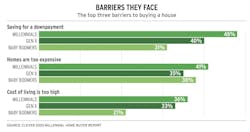

All three cohorts are generally aligned on the barriers to buying a home, especially regarding home prices. That said, 43% of Baby Boomers cite homes that do not meet their criteria as the No. 1 barrier, while the younger cohorts are less picky.

Nearly 10% of all homes sold in 2018 were to iBuyers such as Opendoor, Redfin, and Zillow Offers. Nearly 18% of real estate agents present iBuyer cash offers as an alternative to traditional listings, but 98% of those offers are rarely or never accepted.

Despite demand for smaller, denser, and lower-priced units, master planned communities are often geared toward older and higher-income buyers and fail to keep up with (or trust the profit potential) of a more diverse product and price mix to attract sales.

More so than younger cohorts, 26% of Boomers would do “none of the above” among the options offered in this question, but just 7% of Millennials would take that tack.

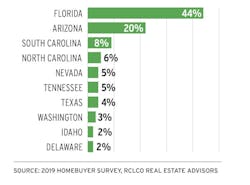

While the majority of retirees rarely move out of state, the attractiveness of better weather, lower taxes, and a master plan of like-minded residents draws some away.

Access a PDF of this article in Pro Builder's February 2020 digital edition